Key Findings from the 2023 Digital Investor Survey

Are Your Digital Marketing Efforts Influencing Investor Behaviour?

Investability has researched the habits of investors to gain a better insight into how professional and retail investors judge a listed company’s digital presence, where they get information about listed companies online, and how great of an impact this information has on their investment decisions.

In this blog, we outline the changing landscape of investor relations in the digital age.

1. Investors make decisions based on information they find online

Through our work in digital marketing, Investability found that digital engagement was vital to successful investor relations. In fact, 97% of respondents said that digital content, such as webcasts, videos, and social media, is an essential part of their investment decision-making process. This highlights the importance for companies to have a strong digital presence and to provide high-quality digital content for investors.

Source: 2023 Digital Investor Survey

2. Increased Overlap of Institutional and Retail Investors

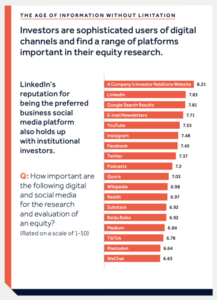

Institutional investors are leveraging on traditionally retail-orientated online spaces. This is a trend born from digital platforms increasingly creating decentralized information-sharing channels, which we will continue to track.

Platforms that have traditionally been associated with retail investors (such as social media platforms and stock forums) are gaining popularity and importance with institutional investors.

Source: 2023 Digital Investor Survey

Of those familiar with Reddit, 46% of respondents expect to use the platform more in the next year, and more than half had made investment decisions based on insights from the platform. On a broader scope, Reddit continues to grow as a platform for investment advice with more than 33 million finance conversation (Reddit, 2022) threads on the site, which has caught the attention of institutional investors with nearly half following key subreddits.

3. Aggregation in response to the deluge of data

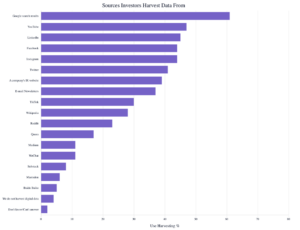

Investors are also turning to new platforms and tools that help aggregate and analyse information.

Investors were asked whether they use tools like AI and machine learning to help them collect and analyse digital and social media data as part of their research into companies – the vast majority (94%) said they use these tools to harvest data.

Google search and YouTube top of the list of sources investors use to collect data. Search engine optimization (SEO) plays a large part in the discoverability of website content by audiences and communicators often place importance on SEO as a tool for other audiences, like customer content.

However, regarding investors, materials like financial results and annual reports are often published as PDFs or downloadable files. Search crawlers, which help surface relevant content on search results on Google and videos from YouTube, are unable to read these types of files. When crafting content, companies should consider which information algorithms may or may not be able to read and how it is presented on their website, both from a human and machine user perspective.

Advances in generative AI platforms such as ChatGPT are rapidly changing search and research behaviour. It is too early to tell how these advances will impact the way investors are using tools to collect and analyse data about equities, but it is a story we will continue to track.

Source: 2023 Digital Investor Survey

Newsletters & podcasts are a growing part of the research toolkit

Investors may also be turning to newsletters and podcasts in response to the vast information available on digital and social media channels. The formats provide primary research, often from a trusted source, in a quick-read, easy to listen format to help quickly digest information.

Among the investors surveyed, 90% said they subscribe to one or more podcasts and 85% subscribe to one or more newsletters. Both are considered trusted sources of information – ranking fourth and fifth on trust overall.

The shift in newsletter formats could be driving this trend. Email newsletters were once a basic roundup of article links. Now, they provide market insights directly to inboxes, and are a highly trusted source by investors, who consider newsletters to be more accurate than traditional media.

Conversely, with dedicated resources and teams for research, podcasts can go deep rather than wide in their coverage and allow listeners to fully submerse themselves in the facts and analysis. Podcasts also provide an easy and accessible way to get key information on the go. That’s why it’s no surprise that podcast use is expected to increase among half of the investors surveyed.

With widespread use and adoption amongst investors, newsletters and podcasts are excellent mediums for companies to tell their stories and should be considered part of the media mix.

What actions can companies and their leadership can take to be more helpful for their equity research?

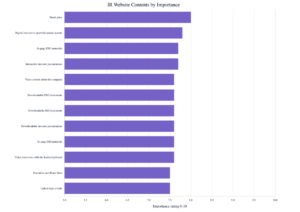

1. Investors are seeking interactive IR website content

IR websites hold immense value in the eyes of institutional investors: 84% of respondents thought it was important for the equities they cover to have an IR website. Here’s what investors want to see:

Source: 2023 Digital Investor Survey

Investors find a range of materials important and helpful. Stock price and key investor materials expectedly top the charts; however, our research found there was a preference for digital interactive and in-page content, rather than downloadable documents which has been precedent for most investor materials.

Investors seeking digital interactive content reflect broader online content trends, and companies should consider the production value of their IR websites with the same regard as for their consumer and employee-facing websites. While companies will still face the obligation to produce these financial materials as downloads, these new investor preferences offer additional opportunities for companies to create interactive materials to advance their corporate narrative.

2. CEO presence on social media is important to investors

Executive social media channels offer an additional avenue to connect with investors that can complement traditional investor relations and broader company communications. The research found that investors are utilizing social media to follow and learn more about the CEOs of the equities they cover. Subsequently, there is a growing contingency of executives turning to social media channels to communicate with their key stakeholders, including investors.

3. The jury is still out on virtual vs. in-person investor events and meetings

We sought to understand whether investors preferred attending events in person or virtually, and the research shows that investor preferences are evenly split between the two.

While in-person meetings are well and truly back post-covid, virtual investor days have also had several upgrades, including high-quality production, news-style programs featuring pre-recorded segments, and live Q&A via platform chat functions. Investor expectations are higher based on these innovations, and companies should be making use of them for their investor days.

Maximising Your Digital Investor Communications

Investors want to see more:

- Interactive content for annual reports, ESG disclosures, and earnings

- Making investor sites as equally engaging as customer-facing sites

- CEO presence on social media

- Virtual and in-person events/meetings

What’s out?

- Creating all investor content in PDFs

Conclusion? Investors make decisions based on information they find on digital channels, and companies should be using digital tools to reach and engage investors as a matter of course.

Investability is a full-service investor and media relations firm with a strong focus on digital investor marketing. We have a successful track record of helping companies communicate and connect with quality investors online. Like to hear more? Contact us today.

![Sydney’s start-up scene now hosts over 2,000 active tech companies – backed by a layered VC stack that writes everything from A$50 k pre-seed cheques to A$300 m growth rounds.

What does this mean for corporates, founders and institutional investors?

👉 Check it out here: [Link in Bio]

#investing #growth #IR #SydneyVC](https://investability.com.au/wp-content/plugins/instagram-feed/img/placeholder.png)