Impact of the Russian Invasion of Ukraine on Share Markets

The unfolding Russian invasion of Ukraine illustrates how geo-political events can have a significant – but typically short-term – impact on share markets when they erupt.

The invasion means analysts are looking into their crystal balls to predict what will happen, whether it be energy prices, wheat prices, banking systems, central bank policy, or the German economy. You name it, they’re analysing it.

But when all the words are written, and all the opinions aired, history tells us that geo-political risk, which is always with us, has had little impact on share markets in the long term. The simple fact is that there is little correlation between major geopolitical events and market upheavals.

Historical Share Market Trends

When the biggest share market crash occurred in 1929 (an event that ushered in the Great Depression), the world was relatively politically stable. It was largely economic events that saw markets struggle in the 1930s. Moreover, the 1987 share market crash occurred at a time when the world seemed relatively benign, with the collapse of the Soviet Union and its European satellite states still to unfold.

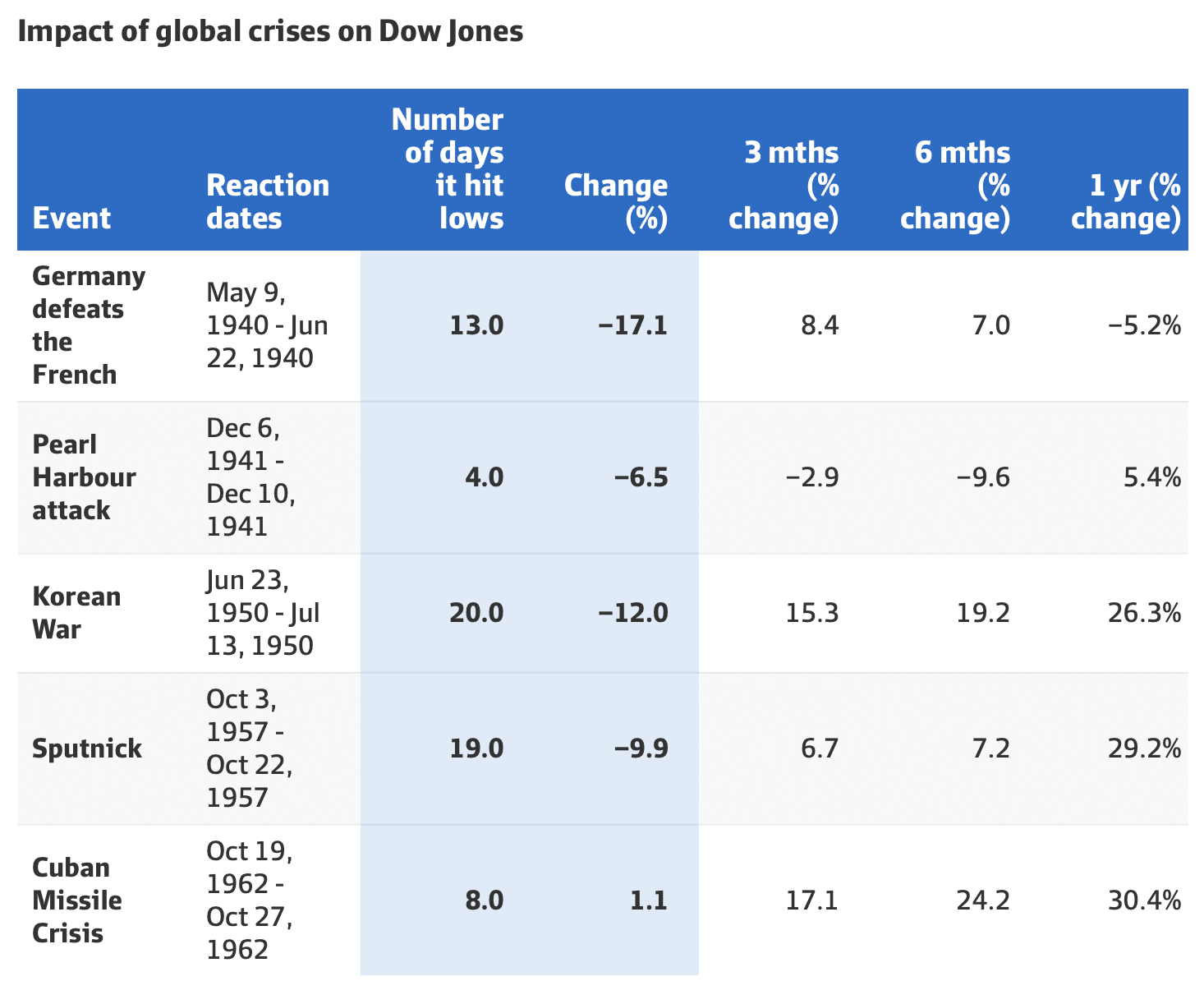

Over the last 90-years (1930-2021), major geopolitical events have jolted markets, but not derailed them. Pearl Harbor pushed markets down – but despite this being such a major event of World War II, the markets soon rallied. Indeed, the bull market of the 1950s started well before World War II even finished and wasn’t affected by the ensuing Korean War in the early 1950s. The Cuban missile crisis (1962), numerous Middle East conflicts, even September 11, have had little sustained impact on markets.

See more recent examples here (Source: COPPO REPORT via AFR).

Despite this demonstrated history, analysts always seem to fall for the same common trick; that this time it will be different.

The caveat of looking back on history for guidance is that nothing is ever guaranteed, and the past is not a predictor of the future. However, a prudent strategy for long-term investors is to hold their nerve and look for buying opportunities, as volatility and sharp market moves due to geo-political events are usually fleeting.