Carbon Credits: A Tool to Incentivise Change and Achieve Net Zero Goals

Key Takeaways

-

Carbon credits were devised as a mechanism to reduce greenhouse gas emissions.

-

Carbon credits were formulated with the intention of creating a marketplace for carbon, essentially putting a price on carbon, and to act as a monetary incentive for companies to reduce their carbon emissions.

-

1 credit = 1 tonne of carbon dioxide

-

There are two primary markets for carbon – the regulated market (mandated by governments to achieve stated net zero targets) and the voluntary market (for those who want to accelerate the reduction in carbon emissions).

-

The voluntary market is tradeable and represents an investment opportunity.

-

Currently, individuals are largely unable to directly invest in voluntary carbon credits, however, there are a few ways you can invest indirectly.

While almost everyone has heard of carbon credits in Australia, not everyone knows what they are, why they were created and how you can access and profit from them.

We recently produced a three-part educational series on carbon credits for fund manager Tribeca Investment Partners and thought we’d share the key points here.

What are Carbon Credits?

Carbon credits, also known as carbon offsets, are permits that allow the owner to emit a certain amount of carbon dioxide – 1 credit permits the emission of 1 tonne of carbon dioxide (or the equivalent in other greenhouse gases).

Carbon credits were established with the intention of creating a marketplace for carbon, essentially putting a price on carbon, and therefore incentivising a shift in behaviour from governments, corporations and individuals to reduce their carbon footprint.

Proponents of the carbon credit system say that it leads to measurable, verifiable emission reductions, not only from big polluters (the aviation and cement industries have been heavy carbon emitters historically), but also by encouraging investment in certified climate action projects that reduce or remove greenhouse gas emissions. An increasing price of carbon will encourage action from those on both sides of the equation.

A Tale of Two Markets

There are two primary markets where carbon credits are traded. The compliance market and the voluntary market.

Compliance Market:

Some businesses are required by government regulations to reduce their carbon footprint over a certain time frame. The compliance market allows businesses to buy carbon credits to comply with the regulations, if they are unable to reduce their emissions through direct action (for instance, shifting from diesel trucks to hydrogen powered trucks). It also allows these businesses to be rewarded by earning carbon credits if they reduce their emissions faster than they are required to, by selling their surplus credits (this is what’s referred to as a “cap and trade” system).

Although this is the largest carbon market, it’s important to note that carbon credits aren’t fungible across marketplaces (i.e. if you’re an European emitter of carbon captured under EU regulations, you can’t buy an Australian carbon credit to offset these emissions). In Australia, we have ACCU’s (Australian Carbon Credit Units), overseen by the Government and Clean Energy Regulator.

Voluntary Market:

The market for carbon credits purchased voluntarily (rather than for compliance purposes) can be used by businesses that wish to accerlate a reduction in their carbon footprint. Importantly, this market is tradeable, so also allows for speculation and investment in carbon credits.

Voluntary carbon credits are also important because they direct private financing to climate-action projects that would not otherwise get off the ground. McKinsey notes that these projects can have additional benefits such as biodiversity protection, pollution prevention, public-health improvements and job creation.

It is important to note that carbon credits can’t be utilised to offset a company’s emissions unless the carbon credit is retired. Once retired, the carbon credit can’t be on-sold or used again. Each year roughly 80% of available voluntary carbon credits are purchased and retired by corporations who wish to reduce their carbon footprint.

The Voluntary Market: A Unique Opportunity for Investors

According to Tribeca Investment Partners’ Portfolio Manager, Todd Warren, the global voluntary market today in 2022 is worth about $1 billion, whereas a mere 18 months ago it was worth about $300 million. So the increase in the size of the market has been significant in a short amount of time.

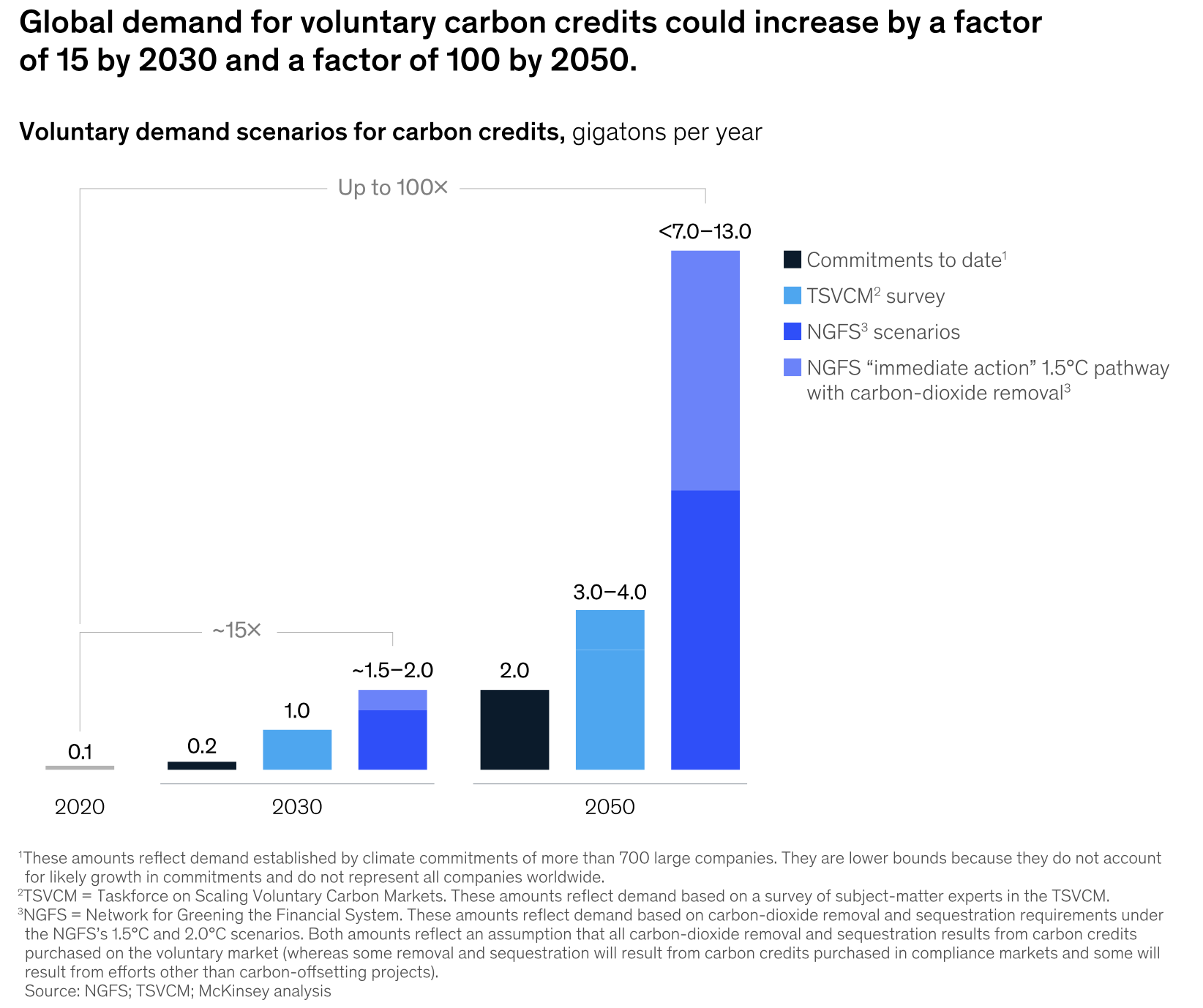

Reinforcing this growth thematic, the Taskforce on Scaling Voluntary Carbon Markets (TSVCM), estimates that in order to meet the climate change targets as set forth in the Paris Agreement, the voluntary carbon markets will need to grow 15 fold by 2030, and 100 fold by 2050 – from today’s levels.

As a result, we should see an even greater increase in the size of the voluntary market.

With demand only heading in one direction, there appears to be a tremendous investment opportunity in the voluntary carbon market.

So, how do you invest?

Investing in Carbon

The sum of the challenge of buying voluntary carbon credits, setting aside the opportunity, is that there is no centralised custody arrangement and securing supply is very challenging. Voluntary carbon credits are largely traded over the counter (OTC). The buy/sell spread is wide and pricing transparency is poor. You need to be very experienced, understand where these credits are trading, who is trading them, who are the right brokers and indeed, what is the right price.

Furthermore, it’s very difficult to become a registered entity able to buy these credits. For example, if you want to buy a certified Rainbow RDA credit (a nature based carbon credit), you will need to have an account with an outfit called Verra in the US, an NGO who is also the registry for that credit… and Verra doesn’t open up an account for just anybody (it’s a very time consuming process).

In summary, individuals are at present largely unable to invest directly in voluntary carbon credits. However there are currently a number of ways you can invest indirectly in carbon credits:

-

Invest in a fund (like Tribeca’s 2050 Strategy) which is registered to buy and trade carbon credits.

-

Invest in a carbon credit ETF which tracks the carbon market (such as the soon to be listed VanEck Global Carbon Credits ETF (ASX:XCO2).

-

Purchasing shares in companies that sell carbon offsets (a privatised form of carbon credits).

What’s next for the Voluntary Carbon Market?

Australia’s carbon markets continue to grow and mature and the Australian Federal Government’s appointed regulatory administrator, The Clean Energy Regulator, is in the process of developing an Australian Carbon Exchange. This exchange will operate in a similar way to existing stock exchanges – enabling the purchase, clearing and settlement of Australian Carbon Credit Units (ACCUs) and potentially other types of carbon units and certificates. The Clean Energy Regulator anticipates that the platform could be launched in 2023.

In the private sector, National Australia Bank (NAB), launched a carbon trading pilot known as Carbonplace with Natwest, CIBC, and Itau Unibanco. More recently UBS, Standard Chartered and BNP Paribas have joined the pilot. The platform will provide the IT infrastructure to facilitate reliable, secure and scalable trading of high-integrity carbon credits, and aims to launch by the end of 2022.

These platforms aim to reduce the barriers to entry in the voluntary carbon market, making this an even more accessible and appealing investment instrument.